They arrested the wrong guy. Sam Bankman-Fried likely violated federal law and a whole bunch of securities regulations. But he’s not the one who should be in jail. It’s the venture capitalists who piled on the real cash, and the politicians who lent respectability to what essentially is the financial equivalent to snake oil who are to blame.

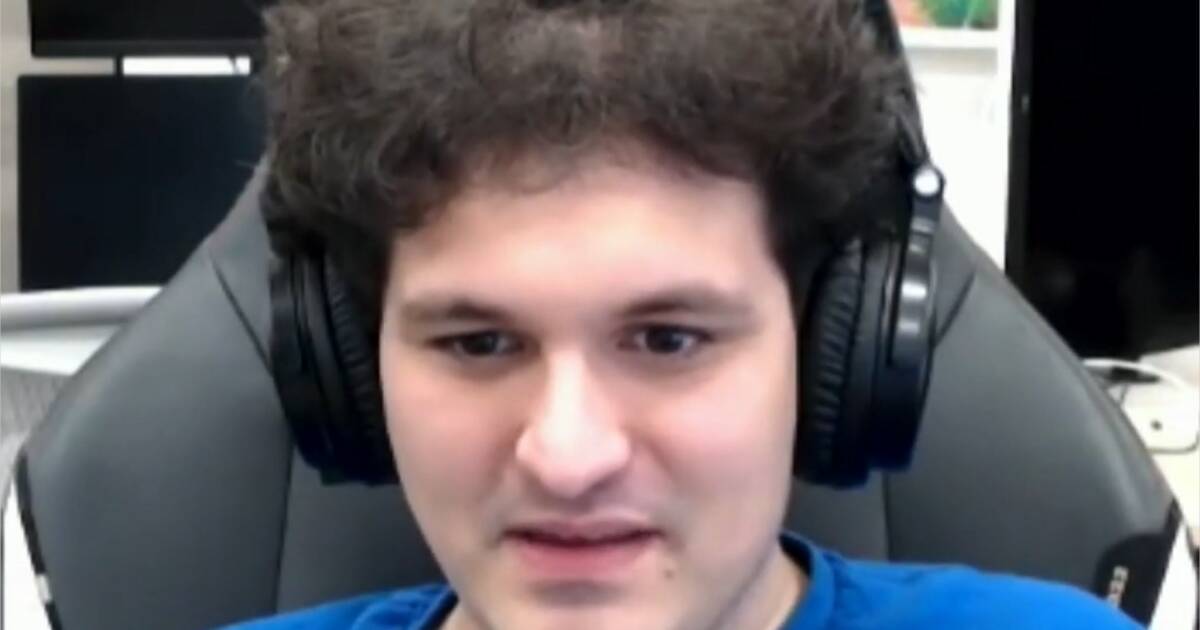

Bankman-Fried had all the right credentials. Wall Street, hedge funds, connected parents–a Stanford Law professor dad, an aunt who is dean of the Columbia University school of public health–an MIT education, elite liberal friends. Nobody gave a second thought to ask him why FTX lacked a risk management department, or even an accounting department. They just handed him hundreds of millions of actual dollars, while marks customers bought cyber coins in the FTX exchange.

They knew that Bankman-Fried’s Alameda Research had complete and unfettered access to the cybercurrency piggy bank, and they knew Alameda was using FTX trade information to place risky bets on other crypto products.

Oh, they knew.

It’s not as if there weren’t any red flags, as my Bloomberg News colleague Layan Odeh reported. The potential for conflicts of interest between FTX and Bankman-Fried’s Alameda, and the lack of a proper board of directors were only the most obvious. The Ontario pension fund for teachers, which wrote down its $95 million investment in FTX, called its due diligence “robust” and said that “no due diligence process can uncover all risks especially in the context of an emerging technology business.” True, but the effort can’t just entail asking a question and then taking the founder at his or her word. Trust but verify. Even a basic amount of scrutiny would have exposed blatant shortcomings in how FTX operated.

Bloomberg: FTX Benefited From Venture Capitalists’ Suspension of Disbelief

But the big story here isn’t the cozy cronyism of the elite left (by the way, Bankman-Fried secretly gave to Republicans too). The same folks who allowed the 30-year-old to get way out over his skis are now going to throw him to the wolves and federal prosecutors. He’s going to serve some token amount of federal time, and wear an ankle bracelet for a few years in penance, before he can write a book about his failures and turnaround.

No, the big story is the fact that all cryptocurrency is ripe for stealing and always will be.

The list of crypto-fueled crime, outright theft of people’s hard-earned cash, is long. It’s also very consistent. Here’s a small sampling.

- Hackers stole about $477 million of FTX coin have started to launder it into Bitcoin. (CNBC, Nov 21)

- In 2022, hackers have purloined more than $3 billion in cryptocurrency, up from $2.1 billion in 2021. (CBS News, Oct 13)

- The DOJ arrested two individuals and seized $3.6 billion in stolen cyptocurrency related to the 2016 hack of Bitfinex. (DOJ, Feb 8)

- The Worldwide Cryptocurrency Heists Tracker shows $8.8 billion in actual U.S. funds stolen to date, which, at today’s value is worth $45.4 billion. (Comparitech)

- China authorities arrest gang that laundered $1.7 billion in crypto, despite crackdown. (CNBC, Dec 12)

Thieves have stolen $45.4 billion, with a “b”, of regular people’s investment money, nest-eggs, dreams, and visions. They’ve done it right under the noses of regulators, financial types, banks, and venture capitalists. In fact, I’d say they’ve done it with the help of these people who are supposed to be safeguarding our money.

I’ve never put a single dime into cryptocurrency, because to me there’s no intrinsic value in a “blockchain” wallet based on “mining” large prime numbers to act as keys to what should be a fairly unbreakable encryption. The supposed advantages of cryptocurrency: being untied to fiat currency issued by a central government, being anonymous, and transactional integrity, all fall apart when criminals have the keys to the blockchain and the exchanges that maintain them.

And when there’s a large source of anonymous, unaccountable money, the criminals will find a way to get the keys. China has done its best to shut down cryptocurrency within its borders. In 2021, all Bitcoin, ether, XRP and other crypto miners were ordered to halt activities by Chinese authorities. China’s central bank told financial institutions to stop providing services to crypto providers. But despite this effort, crypto trading continues in China.

Why? Because it’s lucrative to steal other people’s money without them even knowing it’s gone.

Once you put your dollars into crypto, you have lost complete control of your money. It’s in “there” somewhere, waiting for a hacker to get into the exchange. You don’t have the cash, and you also don’t have the coin. You’ve handed it over, and one day, the glowing numbers on your screen showing huge profits will show $0.

The only way to clean up cryptocurrency is to end it. I’m no fan of China, but they’re on the right track–except their version is to have their own government-backed cyptocurrency so the CCP can get in on the action. The answer here is for U.S. lawmakers to declare cryptocurrency illegal, or subject it to the same scrutiny as fiduciary financial products like your 401K. Nobody should have the ability to just take your money and spend it on themselves while maintaining they’re banking it for you, like Sam Bankman-Fried did.

But as I mentioned, Bankman-Fried wasn’t doing anything different than the hundreds of other cyber exchange operators. His Alameda trading company made some really bad bets that all turned sour at once, and that misfortune led to an old-fashioned “run” on the FTX exchange, when the money had been used to cover Alameda’s losses. You shouldn’t be surprised to know this goes on all the time. The difference with Sam Bankman-Fried is that this guy was supposed to be the Golden Child, well-connected, who sat on the stage with Tom Brady. FTX was set to embarrass too many of the wrong people, and for that, someone had to go to jail.

The problem here isn’t that Sam Bankman-Fried had no financial controls. It’s that the cybercurrency market in general isn’t financially controllable in its current form. It’s not even as secure as it’s promoted to be: behold, ElectroRAT. The criminals are in this for the long haul, and they’ve got more patience than the rubes who lose their cash.

The only solution is to end cryptocurrency before we lose another $45 billion, or $450 billion, or a trillion dollars. It’s time to kill crypto.

Follow Steve on Twitter @stevengberman.

The First TV contributor network is a place for vibrant thought and ideas. Opinions expressed here do not necessarily reflect those of The First or The First TV. We want to foster dialogue, create conversation, and debate ideas. See something you like or don’t like? Reach out to the author or to us at ideas@thefirsttv.com.